A few weeks ago, Joan Miró, our Director of eCommerce Solutions, presented an interesting webinar in which he talked about the effects that Spaniards' online browsing has been suffering since the arrival of the pandemic. And although it seems that time has been suspended this year, along with us and many of our daily activities, the truth is that today, with the de-escalation of the virus, we can effectively begin to speak of a “new normal”.

You can also read: Use Case: COVID.19. How digital behavior has changed.

Baby steps, we have returned to our workspaces, to stroll in parks and squares, to visit family and friends, but has that increase we noticed in online purchases been maintained or has it been decreasing? Faced with this question, we believed that it was well worth looking at this data and do a particular case analysis. Review, for example, what changed in eCommerce in the Fast Moving Consumer Goods (FMCG) category and whether online purchases and visits increased or decreased with the pandemic.

What is Netrica?

We’ll make a pause before entering the subject, to clarify that the data that we are about to expose is data obtained with Netrica. But what is Netrica? Well, it’s our digital intelligence solution for eCommerce. A solution based on digital behavior data and focused on users, not on online sites. A solution that measures: the penetration data of online commerce, the market share of retailers, manufacturers and brands in each industry and product category, and the conversion funnel from selecting an item and adding it to the cart to actually buying it.

The sample

So now, let’s get to the point. For this case, we used a sample of 7,500 desktop panelists in Spain, seeking to make them a representative sample of the Internet user population in that country, selecting them based on specific variables of sex, age, location and socioeconomic level. The observed data is their digital behavior, analyzed in a period that includes from January to June 2020.

What did we find?

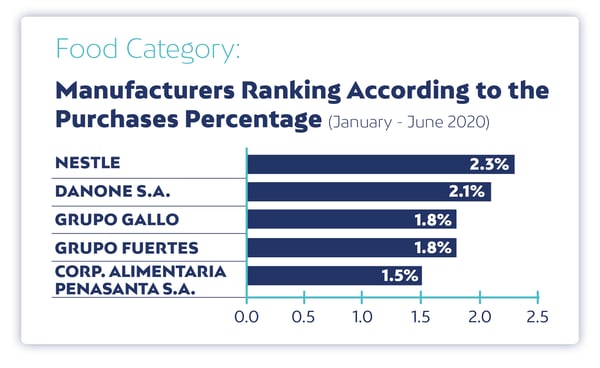

- We were able to see that Amazon, the global online sales and shipping giant, leads in Spain in almost all FMCG categories in terms of buyer penetration (not shocking…), except for food and beverages.

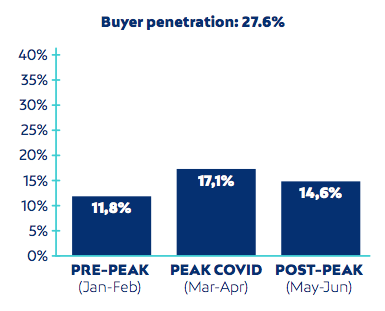

- Just over 54% of this sample of Spanish Internet users visited FMCG online sales sites during the observed period, and about 28% of them actually ended up making a purchase.

- Impressively, there was an increase of over 200%, yes 200%, in online shopping penetration for the following FMCG categories: Household Products, Food and Beverages. Could it be that the online purchase of home products is something that COVID-19 brought us to stay?

The specific case of the food category

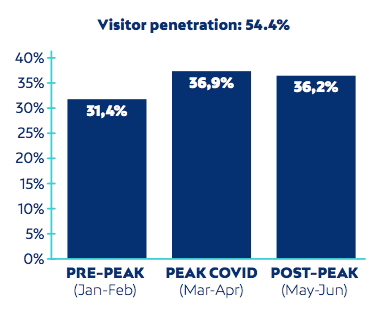

In order to assess the importance of the figures presented below, it is necessary to clarify that we have divided this period of time, January to June, into 3 moments, according to the states of the pandemic: Pre-peak, which includes the months of January to March, Peak of the pandemic, which covers March and April (precisely the months in which the alert state was decreed), and Post Peak, coinciding with the start of the de-escalation during the months of May and June.

- Regarding the penetration of visitors to FMCG eCommerce sites, we can see an increase between the Pre Peak and Peak stages of the pandemic, going from 31.4% to 36.9%. While the fall in the Post peak stage is only 0.7%.

- Now, talking about the penetration of purchases in FMCG online sites, we can see the great increase that occurred between the pre and peak of the pandemic, with a percentage from 11.8% in January and February to 17.1% in March and April. For the months of May and June, the drop was 2.5%. Even so, online sales, with 14.6% purchase penetration during the post-peak, is still 2.8% higher than before the peak.

- Finally, if we look at the ranking of grocery manufacturers according to the percentage of purchases during the first half of this year, from January to June, we can see that the purchase penetration rate is led by Nestlé, which is 2.3% and closely followed by Danone SA, which has a 2.1% of the market share. The Gallo and Fuertes groups each have 1.8%, and finally, we find Corporación Alimentaria Peñasanta SA with 1.5%.

-

It is true that this pandemic forced us to modify many aspects of our daily lives, but it is also true that once it is over, there will be things that will not return to their previous form, thus building the “new normal”. We have seen a clear increase in the trend of purchases of consumer products through online sites, and it would not be surprising to think of near-future where physical visits to supermarkets decrease proportionally to the increase in online purchases. In what other categories do you think the same could happen?

Read also: A sample against COVID-19.

Are you interested in learning more about digital behavioral data and/or our digital intelligence solution for eCommerce, Netrica? Contact us via email at netrica@netrica.com

- Regarding the penetration of visitors to FMCG eCommerce sites, we can see an increase between the Pre Peak and Peak stages of the pandemic, going from 31.4% to 36.9%. While the fall in the Post peak stage is only 0.7%.