After more than a year, there is likely not a single person on this planet who does not have at the ready at least 5 ways in which their life has changed since the start of COVID-19 and lockdown. If you were to ask me, the first thing I would say is that I started caring for my health more by seeing a nutritionist or dietitian and increasing how often I go to the gym. And you, would you first say that you spend more time with your family or that you have gone through the Netflix catalogue more than 3 times?

It would seem tiring to keep exploring, and exploiting, the topic of COVID, but, at Netquest, we are crazy for data, and this led us to carry out a collaboration with Atlantia Search in Mexico that resulted in the study Resilient Consumer. The objective of this study was to share a glimpse into the behavioral changes of the Mexican consumer’s purchases, habits, and preferences. Even more importantly, this study aimed to identify the resilience level of Mexican households in the face of the public health crisis.

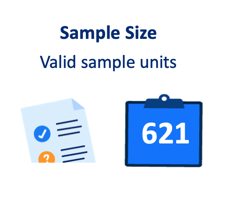

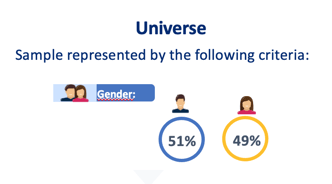

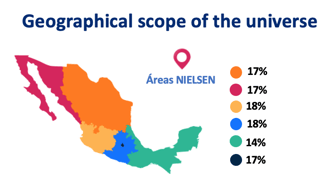

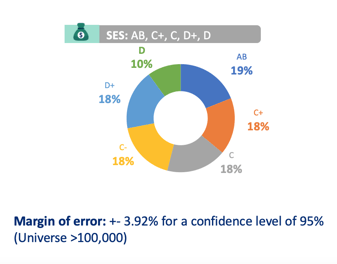

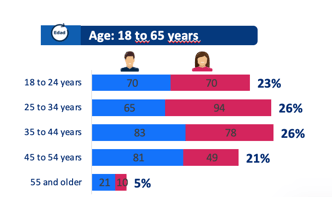

With a sample of more than 600 Netquest panelists in Mexico, made up of 49% women and 51% men between 18 and 65 years old, with all socioeconomic statuses and Nielsen areas represented.

This study was divided into four main sections:

- Mexican households

- Transformation of daily life

- Resilient consumer clusters

- Changes in the Mexican consumer

Without a doubt, the job of collecting and interpreting the data was so big that it is impossible to capture everything here. Therefore, we recommend that you download it so that you can familiarize yourself with it in more depth. You just need to click here. (Available only in Spanish 😜)

In any case, I would like to present to you some of the data that we found. They represent a new reality not only for the families of the country of mariachis, but also for the brands and products that are looking to find a spot in Mexicans’ shopping carts (physical or digital).

Mexican households

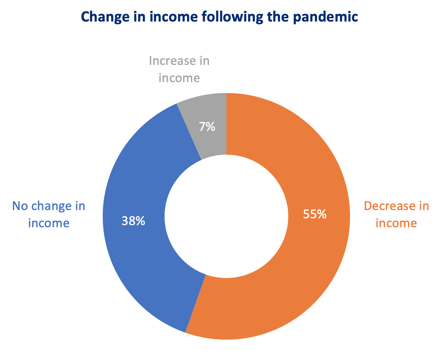

- 5 out of every 10 Mexicans saw a decrease in their income following the pandemic, which largely impacted women and socioeconomic levels D and D+, as well as people older than 55. Only 7% of survey participants reported that their income increased and 38% reported that it stayed the same.

- We noticed an increase in the already existing inequality between men and women, as 1 out of every 3 women found herself unemployed after the pandemic, whereas the percentage of unemployment per gender was 34.9% among women and 17.6% among men.

- Even with numbers such as the ones mentioned here, Mexicans appear to be optimistic in the face of their expectations for the near future: 7.4% of survey participants expect an increase of 10% to 50% to their income in 2022.

Transformation of daily life

- It is no surprise that work modality has changed, but here are the numbers: 7 out of every 10 Mexicans experienced some sort of change. Furthermore, a third of the population will keep the flexible work model (permanent home office 17% or hybrid 18%), which will allow people to enjoy more free time.

- Speaking of free time…4 out of every 10 people surveyed noticed an increase in their free time following lockdown. 66% said that they browse the internet more since the start of the public health crisis, which presents a huge business opportunity for brands, advertisers, and e-commerce platforms. 60% reported watching more streaming content and 49% are watching more televisión in lockdown .

- And, since there is definitely even more free time left over, 8 out of 10 panelists said they were engaging in more household activities following the pandemic, such as cleaning and cooking at home.

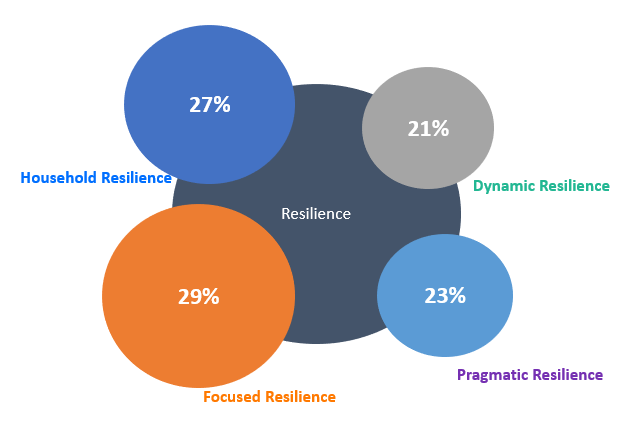

Clusters, or groups, of the resilient consumer

In case you don’t remember, resilience is the capacity to get through adverse moments and adapt to different situations. With this brief reminder, I can now tell you how Atlantia, with #DatosNetquest, successfully identified 4 groups among Mexicans with different resilience levels:

1. Household resilience. Made up of 27% of the sample, they are middle to lower-middle class households of 25 to 44 years with children in the home. They are panelists who reported that they have little free time, which they enjoy by spending time with others in their household and with traditional entertainment, such as the 56% who watch televisión. The consumption of streaming and internet browsing were digital trends they took up with the start of the pandemic.

2. Focused resilience. This group contains 29% of those surveyed. They are also middle to lower-middle class households of 25 to 44 years with children in the home. The big difference between this cluster and the previous cluster is that this was one of the most affected groups in terms of income and occupation. These people continued going to work in person, and, therefore, do not feel like they have more free time and reported that their life is similar to before the pandemic. They’re focused on carrying out the day-to-day, mostly spending on basic products and services, such as maintaining and caring for their homes and households.

3. Dynamic resilience. Represented by 21%, they are middle to upper-middle class households and predominantly younger. Worried about their health as a whole, they are the group that concerned itself with its mental health by getting therapy and maintaining this expense throughout the pandemic (20%), and 27% began to play sports.

4. Pragmatic resilience. Made up of 23% of the sample, they are middle to upper-middle class households, predominantly from the country’s capital. They are young people who saw their income change, and, also, noticed an increase in spending since staying at home more to work. From the new digital trends, they took up online education and dedicated their time to learning something new. They were the cluster that decreased their self-care spending the most because they didn’t see the point in spending in this category since they were spending more time at home and participating in fewer social activities.

Changes in the Mexican consumer

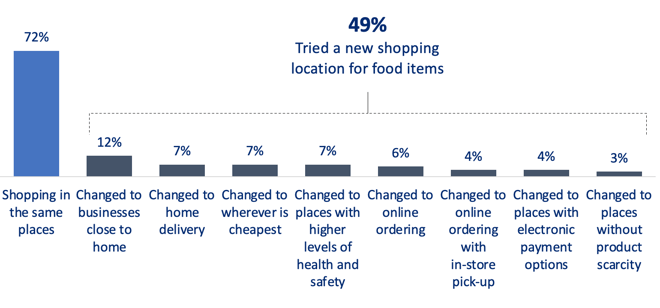

- 50% of consumers tried a new shopping location for food items following the pandemic, mainly to support local businesses (12%).

- The main shifts in terms of procurement channels were due to two factors: having a place closer to home (41%) and going to places perceived to be safer (25%). This explains why the channel with the most losses was the one with markets and tianguis (in other words, markets on wheels or street markets).

- The pandemic increased brand discovery. On average, each person tried 3 new brands. Those who bought or tried a new product during this public health event did so from a business/brand with which they were already familiar and that provided a certain level of security and guarantee, in addition to shopping with a sense of economy and utility.

And so, as I was telling you at the beginning, this is only some of the data that we found in this study. Without a doubt, it is almost a manual for brands and advertisers to get to better know the new Mexican consumers. Once again, I invite you to download the results and - why not? - to reflect: which cluster do you and your household belong to and what caused these changes to your shopping, given that you may choose to order vegetables to be delivered instead of going to personally pick them up.